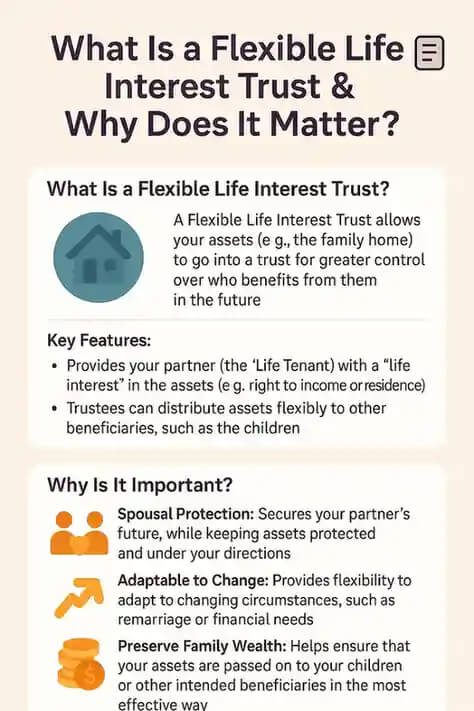

Creating a Flexible Life Interest Trust is a very important decision and it’s only natural that you think about what would happen if you change your mind further down the road.

Here’s the honest truth:

Once this kind of trust is established, it’s typically not the sort of thing you can just change or undo. And it becomes a binding legal document, which is created to ensure that your exact wishes are carried out.

But don’t let that worry you. The “flexible” part isn’t that you can cancel it, but rather that the people you designate as your trustees (agents under a trust arrangement) have the authority to tweak how the assets are invested and used in ways that best serve your loved ones at different stages of their lives. If, for example, you were to die one day and your spouse needed additional help, the trustees at that time could exercise their judgment on her behalf as they would have a duty to do under the trust.

“If you think there’s a possibility that you will want to terminate or re-write the trust in full at another time, it would be unlikely, but possible” under very specific circumstances for example if you gave yourself certain powers from the outset, or under certain legal conditions all beneficiaries agree.

That’s why clearer guidance before establishing any trust is so important. And it does this whilst you can be confident that they accurately represent your true wishes both now and for the future that you want your family to have.